bitcoin may

Bitcoin added more than $200 Monday at one point amid a major New York conference on digital currencies, following a surge in weekend interest from Asian investors.Bitcoin was last trading near $2,236, about $400 short of doubling in value for May.On Monday, the bitcoin news site kicked off its two-and-a-half-day digital currency conference, Consensus.The third annual conference is expected to draw more than 2,000 attendees to New York."There is a lot of excitement and announcements of new projects which is contributing to the euphoria," said Brian Kelly, CEO of BKCM.Also on Monday, an alliance for a digital currency system called ethereum announced 86 new members, including financial communications company Broadridge, clearinghouse DTCC and consulting firm Deloitte.Units of non-financial firms Samsung, Merck and Toyota also joined the Enterprise Ethereum Alliance, which counts JPMorgan, Intel and Microsoft among its initial members.The alliance seeks to develop technology and standards for ethereum, which some see as a potential structure for a decentralized, next-generation internet.

"What we're seeing is people realizing that there's a macro impact to how we operate the economy potentially," Andrew Keys, head of global business development at blockchain software developer ConsenSys, told CNBC in a phone interview.Blockchain is the financial accounting system underpinning bitcoin, ethereum and other digital currencies.In addition to Consensus, at least two other conferences on cryptocurrencies are being held in New York this month: the Ethereal Summit — attended by 471 people last Friday — and the Token Summit scheduled for Thursday.Investors typically use bitcoin to buy other digital currencies, and interest in those assets helps drive up bitcoin's price.On Monday, bitcoin trade volume in U.S.Trade volume in Chinese and Japanese currencies moderated to 16.95 percent and 34.2 percent, the website showed.Over the weekend, bitcoin topped $2,000 for the first time as trade volume from Japan jumped to 55 percent from 40 percent last week.Analysts also noted bitcoin prices on Chinese exchanges narrowed a recent trading gap with the U.S.-dollar price on expectations that Hong Kong-based Bitfinex is expected to soon restore easy conversion between bitcoin on its exchanges to U.S.

Japanese authorities increasingly recognize bitcoin as a legal currency — major retailers began accepting it in April.Several billion in U.S.dollars have flowed into bitcoin in the last week, bringing its market value to more than $37 billion Monday, according to CoinDesk.Correction: This story has been updated to reflect that bitcoin was about $400 short of doubling in value for May.

mcxfee bitcoinBitcoin has more than doubled in price this year alone, but it has been outperformed by its closest rival Ether, which is up over 2,300 percent.

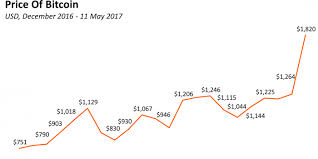

damnit maurie bitcoinOn January 1, bitcoin was trading at the day's high of $1,003.25.

stephen mihm bitcoinOn Wednesday, it broke through the $2,300 barrier for the first time to hit a fresh record high of $2,377.32, according to CoinDesk, marking a year-to-date rise of 137 percent.

To find out what's driving bitcoin's rally, read more here.Meanwhile, bullishness around bitcoin has stoked appetite for other cryptocurrencies.One in particular known as ether is getting traction.This represents a 2,367 percent rise year-to-date.Ether runs on an underlying technology called Ethereum, which is a different blockchain to the one that underpins bitcoin.While ether does have digital "coins" like bitcoin, companies are more focused on how the Ethereum blockchain could be used in real-world applications.Ethereum has been designed to support so-called smart contract applications.A smart contract is a computer program that can automatically execute the terms of a contract when certain conditions are met, potentially taking a lot of the human involvement out of completing a deal.Barclays for example, have used a form of this technology to trade derivatives.How is it different to bitcoin?Firstly, Ethereum is a lot younger having only been started in 2014, whereas bitcoin began in 2009.

Ethereum is also focused on smart contracts, while bitcoin is very much about payment technology.Why has ether rallied so much?While bitcoin has been getting support from certain governments and investors, the Ethereum blockchain has been backed by corporates wishing to use the technology for smart contract applications.A group called the Enterprise Ethereum Alliance (EEA) was recently founded to connect large companies to technology vendors in order to work on projects using the blockchain.Companies involved in the launch include JPMorgan, Microsoft and Intel.On Tuesday, the EEA announced another 86 firms joined the alliance, which is adding growing legitimacy to the cryptocurrency.At the same time, the rally in bitcoin has seen investors turn to alternative digital currencies as well as attracting a broader investment base.A year ago, over 83 percent of ether buying happened with bitcoin, according to data from CryptoCompare, showing that it was mainly crytocurrency enthusiasts interested in it.

As of Wednesday, bitcoin accounted for just over 32 percent of trade while fiat currencies such as the U.S.dollar and Korean won have risen sharply."Yes the direct fiat flow options are a fleshing out of the ethereum ecosystem and show its broad appeal," Charles Hayter, CEO of CryptoCompare, told CNBC by email.Will the rally last?Not all in the market are convinced that the ether rally will last.Bitcoin trader Jason Hamilton is worried that products like Ethereum could be cloned."People are buying a specific blockchain, but the big interests are in the technology.They'll probably make their own clones and the ether tokens everyone is buying won't be used for much except trading.Who knows, though," Hamilton told CNBC via a direct message on Twitter."I don't usually trade ether.I'm afraid of that bubble bursting, but it could go on bubbling up for a long time still."Gross: Bitcoin Potential Substitute for Monetary Coinage New financial technologies such as bitcoin may become increasingly attractive to investors as a protection against central bank low- and negative-interest-rate policies that threaten capitalism, according to billionaire bond manager Bill Gross.Policies by the Federal Reserve, Bank of Japan and European Central Bank are destroying historical business models that foster savings, investment and economic growth, Gross, who runs the $1.5 billion Janus Global Unconstrained Bond Fund, said in an October investment outlook released Tuesday.

He said that as investors lose faith in the system, they will increasingly seek havens.“Bitcoin and privately agreed upon blockchain technologies amongst a small set of global banks are just a few examples of attempts to stabilize the value of their current assets in future purchasing power terms,” he wrote.“Gold would be another example -- historic relic that it is.In any case, the current system is beginning to be challenged.” Blockchain is the technology underlying bitcoin, a digital currency that uses encryption techniques to generate new money and verify fund transfers, independent of a central bank.Two members of the U.S.Congress formed a caucus last month to advocate for cryptocurrencies and blockchain-based technologies, which may require new laws to thrive.Central banks are acting increasingly like casino gamblers who double down on bets every time they lose, according to Gross, a strategy that works as long as they can print unlimited amounts of money.The approach, which aims to encourage borrowing and economic expansion, has failed to create sustainable growth while driving investors into increasingly risky assets as they seek higher yields, he said.“Central bankers have fostered a casino-like atmosphere where savers/investors are presented with a Hobson’s choice, or perhaps a more damaging ‘Sophie’s Choice’ of participating (or not) in markets previously beyond prior imagination,” Gross wrote, hammering a favorite theme.

“Investors/savers are now scrappin’ like mongrel dogs for tidbits of return at the zero bound.This cannot end well.”In a tweet posted Tuesday, Gross warned: “ECB Taper Tantrum underway.Bearish for Global bonds.”European Central Bank officials have reached an informal consensus to wind down bond purchases, which have been running at 80 billion euros ($90 billion) a month, a signal that they are reducing efforts to stimulate the economy through ultra-loose monetary policy, Bloomberg reported.A so-called taper tantrum rocked the U.S.bond market in 2013 when then-Federal Reserve Chairman Ben Bernanke signaled a reduction in monthly purchases of Treasuries and mortgage-backed securities.Gross’s unconstrained fund returned 5 percent this year through Monday, outperforming 66 percent of its Bloomberg peers.The fund has returned 4 percent since he took over in October 2014 after an acrimonious exit from Pacific Investment Management Co.Janus Capital Group Inc.announced Monday that it was merging with London-based Henderson Group Plc to form a $320 billion asset manager.