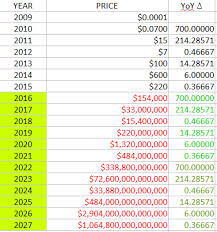

bitcoin lifetime price chart

oregonmines wrote: Nice chart , the 100% by least efficient method, is an interesting way to look at a chips contribution hash wise.11 Mar 2017 18:10 UTC hashingitcom wrote: I like it - I've not run the estimates on mining for a while (busy with other stuff), but I just found one from about 2 years ago where I'd estimated a best case of 160 MW, and a more likely 320 MW at that point in time.Do your energy figures allow for just the ASIC characteristic or have you factored other inefficiencies (especially in PSUs, cooling, etc.)?30 Mar 2017 09:46 UTC mrb wrote: Yes my estimates do take into account inefficiencies (1) of power supplies and (2) of the cooling at the chassis level, because J/GH figures are measured "at the wall."Thereis also the PUE to consider (overhead at the data center level) which is typically very low for mining farms, 1.05 or so.But the *lower and upper bounds* do not need to take into account the PUE.The lower bound, by nature, needs to assume the overhead is zero.

And the upper bound is such a worst-case & unrealistic estimate (by assuming miners deploy the least efficient hardware) that it must surely already overestimate power by at least 5%.For my *best guess* estimates, in theory I should add 5%.But the variance is pretty large at 470-540 MW and not meant to be 5% accurate, so it would not be useful to do so.30 Mar 2017 21:13 UTC CW wrote: Thanks for sharing your analysis.It helped me clear a lot of misunderstandings I had.I still don't understand how to calculate the lifetime income of a miner "By 15 January 2016 84% of the lifetime income of the S5 had been generated".I reviewed the income-antminer-s5.csv but still I cannot understand how you make this calculation.21 Apr 2017 00:43 UTC mrb wrote: CW: By 15 Jan 2016 it had generated $854 of income (last column) which is 84% of the lifetime income of $1021.Well, to be pedantic the lifetime income moved a little bit upward and downward past Jan 2016, depending on diff and BTC price, and stabilized at $1030... 23 Apr 2017 04:10 UTC janhoy wrote: This article http://digiconomist.net/bitcoin-energy-consumption claims an electricity consumption of 110KWh per transaction.

What is your take on that?09 May 2017 13:16 UTC janhoy wrote: /bitcoin-mining-is-not-wasteful/ which I believe explains it :) 09 May 2017 13:43 UTC mrb wrote: Yes./serious-faults-in-beci/ 10 May 2017 22:18 UTC SRSroccoReport wrote: Marc... excellent work on Bitcoin energy consumption.I would enjoy hearing what you would gauge as a current total cost to produce bitcoin and ethereum.

bitcoin lutonI do realize their costs will continue to increase as time goes by, but it would be helpful in comparing cost of production to their market price... especially now that they are highly inflated above their cost of production.best regards,steve 29 May 2017 05:02 UTC mrb wrote: steve: Per the math in footnote 2, currently (difficulty = 596e9, 1 BTC = 2300 USD, assuming $0.05/kWh) the efficiency under which an ASIC is no longer profitable is 0.81 J/GH.

bitcoin lowest price 2016

An Antminer S9 operates at 0.10 J/GH, so electricity costs represent 12% of mining revenues (0.10/0.81), therefore 1 BTC costs 280 USD in electricity.This doesn't count the cost of the hardware which has to be amortized over the lifetime of a miner.My models show that for an end-of-life miner like the S5, 28% of mining revenues need to cover hardware costs, so 1 BTC need to recover 640 USD of hardware costs.So the overall production cost of 1 BTC is 920 USD.

pavol luptak bitcoinBut even this number doesn't account for other smaller expenses: data center, labor.This places the overall production cost of 1 BTC at around 1010 USD.31 May 2017 20:42 UTC Robert L wrote: Thank you for sharing!Really enjoyed reading your analysis.It would be interesting to consider the true energy cost by considering the additional upper bounds of ~30% inefficiency in energy production and transportation to user.

I would imagine the global mean is even higher.12 Jun 2017 02:14 UTC Digiconomist wrote: The problem of estimating Bitcoin energy consumption is a lack of a central register with all active machines.The only certain number is the absolute minimum energy consumption (hash * most efficient miner), but that number doesn't get close to reality as newer machines only slowly push the old ones out.If you're going to derive energy consumption from actual hash you're going to have a pretty big error on the tail.This is the part with most older machines, that relatively have the most impact on total energy use (eg.just 50 PH/s of old S2 miners has the same weight as 500 PH/s of S9 miners).The author heavily relies on economic assumptions in determining the activity of these older machines, which adds a lot of uncertainty regarding this so-called "bound".IMO this hasn't been properly disclaimed in the article.Still I'm happy with it, since it also validates the need for an economic indicator given the reliance on profitability assumptions.

15 Jun 2017 17:24 UTC mrb wrote: Digiconomist: my upper bound already estimates the amount of such older machines by calculating the profitability breakeven point (0.56 J/GH), as explained and disclosed.15 Jun 2017 19:44 UTC Digiconomist wrote: Yes, but it doesn't disclose uncertainty surrounding that number.Average cost per KWh are an estimate, not a given.With 2 cents per KWh that break-even point would more than double & have a big impact on the tail.Only the lower bound is an actual bound.16 Jun 2017 07:51 UTC Digiconomist wrote: The way it's presented makes it seem like the upper bound is of equal strenght as the lower bound.While the lower bound only has some performance uncertainty surrounding it, but the upper bound is a diffent story.If the network was running even just slightly lower at 4 cents per KWh you'd have to include the A3222, which immediately adds 10%(+) to your bound (0.81 TWh).It's not that solid.16 Jun 2017 08:07 UTC Digiconomist wrote: On top of the previous the number is also sensitive to timing (after all there's no guarantee to when machines are actually deployed - shipping and setting up take time too) and hashrate measurement errors.

Timing alone can easily add 5% to the bound (just try shifting the months up by one).And worse: these errors can also stack up.No taking the correct machines into account and getting the timing wrong will quickly result in a 20-30% error on the upper bound.16 Jun 2017 19:20 UTC mrb wrote: Yes the upper bound is influenced by the assumed cost of electricity, and there is some uncertainty about the cost.I disclose this assumption in multiple places.But I do not believe a lower cost would have a significant impact on the tail.Machines produced pre-Dec 2014 (where my chart starts) were produced in relatively small quantities that even their aggregate power consumption is not that high.Case in point: you are wrong about the A3222 potentially raising the upper bound by 10%, because only 79 PH/s of it were produced (see footnote.)If you do the math and assume 79 PH/s of it, then the upper bound only raises by 1.6%.What about RockerBox and Neptune?Well again none of them were produced in large quantities: 0.3% of the hashrate is KnCMiner hardware, and Spodoolies bankrupted themselves due to low volume.As to the timing of ASIC releases and hashrate measurements, the small inaccuracies should average out to zero (some data points slightly overestimating, others slightly underestimating.)Finally, I want to reiterate that the upper bound is based on such an extreme assumption (everyone deploying the LEAST EFFICIENT machines) that it gives us an error margin large enough to account for the bound being potentially 5 or 10% off.In the end, the real power consumption is going to be in between the lower and upper bound, far from each bound.

20 Jun 2017 04:56 UTC Digiconomist wrote: /sYZEBYaAs you can see early phases are responsible for just 14% of the hash, but 29% of the calculated energy consumption is due to these machines.Late stage miners obviously carry a lot more hash (38%), but have a lot less impact on the final figure (they contribute 24%).I also created one showing what happens when you change phase 0 only./a/UMBSNDoing so would cause early phases to be responsible for 40% of the total energy consumption figure, and raise the overall number by 15%.This is what an error in just 290 PH/s at the start can do to your figure.Small number, massive energy weight.Today the break-even J/GH for the network is 0.92 at 5 cents per KWh.We know rates can go as low as 2 cents.Where does that leave old Bitmain S2, S3 and S4 miners?They run at <= 1 J/GH.I'd say this really adds quite some uncertainty to the proposed method.One more thing.I was wondering why the method wasn't repeated in reverse?If you can do it for the least efficient machines why not with the most efficient ones?